E-Way Bills

What is an E-Way Bill?.

In the GST regime, an E-way bill is an electronically generated document necessary for the movement of goods within the state or outside the state. An E-Way bill replaces the waybill, which was a physical document, used in the previous VAT system.

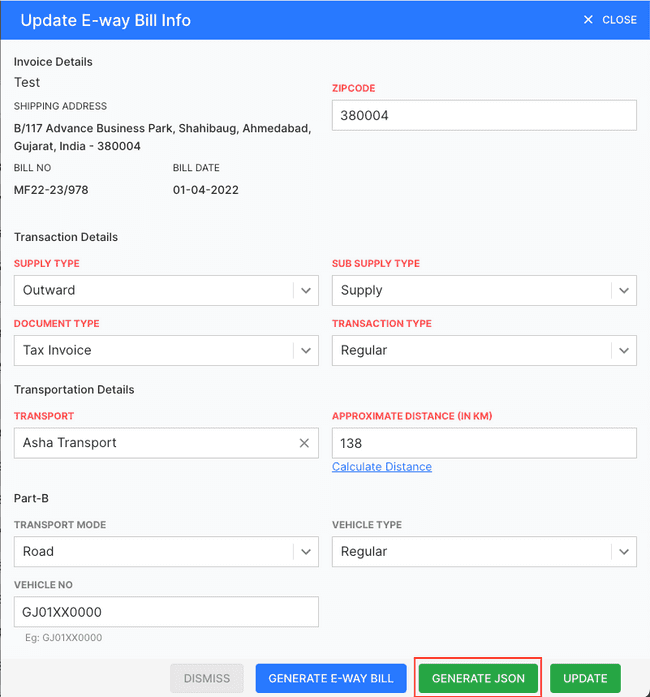

An E-way bill has two parts: Part A and Part B. Part A contains the details of a consignor, consignee, supply type, product details and transport mode and Part B contains details of the transporter.

If you’re initiating the movement of goods and transporting the goods by yourself, you have to furnish both Part A and B details. If you have outsourced the transportation of the goods, then the transporter must furnish Part B details. A consignor or the sender can also authorise a consignee such as buyer, transporter, courier agency and e-commerce operator to fill PART-A of the E-Way bill on his behalf.

When is an E-Way Bill Necessary (or Unnecessary)?

E-way bill is mandatory at the time of movement of the goods as per the guidelines mentioned below. But there are some cases discussed below, where E-Way bills are not necessary though goods are being transported from one place to another.

How to Generate E-Way Bill.

- Go to the INVOICE menu and select E-WAY BILLS.

- Click the ACTION button in the top right of the list.

- Click GENERATE E-WAY BILL.

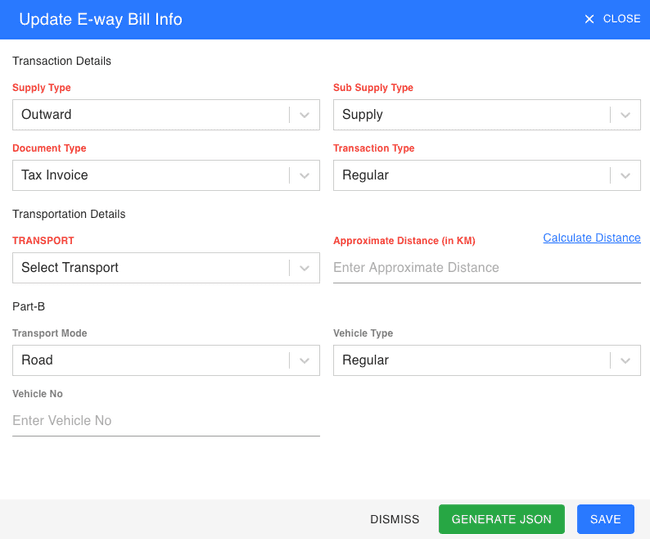

- Enter the TRANSACTION DETAILS and TRANSPORTATION DETAILS.

- After entering all the details, click SAVE.

Other Actions for E-Way Bill.

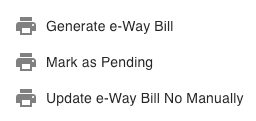

There are a host of other actions that you can perform on a E-Way bill in FinalBooks.

- Generate E-Way bill.

- Mark as Pending.

- Update E-Way bill number Manually.

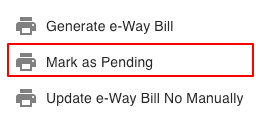

How to Mark as Pending E-Way Bill.

- Go to the INVOICE menu and select E-WAY BILL.

- Click Action-->Mark as Pending in the right of the list.

- Click YES IT to confirm.

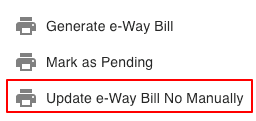

How to Update E-Way Bill Manually.

You can change the details of your existing E-Way Bill No. here’s how:

- Go to the INVOICE menu and select E-WAY BILL.

- Click Action-->Update E-way bill Manually in the right of the list.

- Make the changes and save the E-way bill.

How to Create E-Way Bill.

Video hosted on youtube.com

How to Create E-Way Bill by Json.

- Go to the INVOICE menu and select SALES INVOICE.

- Click Action-->Create E-Way Bill in the right of the list.

- After entering all the details, click *GENERATE JSON.

- Log in E-way bill portal at https://ewaybillgst.gov.in.

- Go to the E-WAY BILL menu and select GENERATE BULK.

- Choose downloaded Json file from FinalBooks & click UPLOAD.

- Click on GENERATE.